NFTs 101 : Talking crypto, minting and early adopters

NFTs or non-fungible tokens are suddenly everywhere. Everyone’s trying to get their heads around this new phenomenon. Because why would people spend millions of dollars on ‘digital collectibles’ that can often be viewed for free ?

From breeding NFT cats on CryptoKitties to racing with NFT horses on ZED.RUN to trading artwork on NFT marketplaces – the world has found its new obsession amidst the pandemic.

Is this an opportunity that shouldn’t slip through your fingers? This article will help you better understand the essence of cryptocurrencies and NFTs, guide you through the process of NFT creation and share some examples of brands that are already embracing the NFT universe.

The genius behind cryptocurrencies

To understand NFTs, we must understand how cryptocurrencies are different to traditional, fiat currencies. The value of fiat money is tied to a government-issued currency like the UK pound, while cryptocurrency is a digital asset that takes its value from its native blockchain.

Fiat currencies are becoming digital to the point where we can make our daily purchases without the need for physical banknotes. However, they still vastly differ from blockchain-powered cryptocurrencies. That difference prompted countries to start considering having digital currencies of their own.

USA lawmakers are trying to pass a bill for a fully digital dollar, Chinese citizens already use digital yuan, and Europe is looking into implementing a digital euro by 2025.

Plenty of people are being vocal against government-powered coins because cryptocurrencies symbolise the ultimate decentralised tool that takes control away from government and big banks. It’s the separation of money and state – the biggest revolution since the separation of church and state. The fact that countries are trying to introduce digital currencies shows how threatened they feel by the crypto market.

In the crypto universe, every single coin can be accounted for as all transactions are public and permanently stored on the blockchain. NFTs are programmed the same, but they are not fungible (exchangeable), meaning that they’re not divisable or swappable.

Therefore, NFTs can’t be exchanged for other NFTs, unlike any fungible token (crypto or fiat currency) that can be exchanged for another fungible token. NFTs can only be bought with cryptocurrencies, as they’re both using blockchain technology.

Blockchain consists of several layers, one of which is the consensus model. That model can either work on the proof-of-work (PoW) or proof-of-stake (PoS) principle.

PoW is used in most crypto tokens today, as well as the popular ones like Bitcoin, Ethereum, or Litecoin. Because of its popularity, it handles an enormous amount of transactions daily. For those transactions to be approved and encrypted into the blockchain, a great amount of equations needs to be solved.

On the solving side of those equations are the ‘miners’ and their computers. You can thank miners for the lack of graphics cards and on the market, as those are often used in the process of mining. Though popular, people don’t realise that them buying a few graphics cards won’t help them amass a crypto fortune, as they can’t compare to the massive mining farms. This is why advanced miners have turned to ASICS chips for their mining processes.

Energy consumption grows with the amount of transactions, partialy attributed to the ever-growing popularity of cryptocurrencies. It is why environmentalists are up in arms about the environmental impact of NFTs and crypto. We’ll examine those claims and why they’re dismissible.

Cryptos are more sustainable than fiat currencies

The big banks know exactly how crypto is interfering with their control on the economy. They also know that environmentalists are a great way to push their agenda since they’re the ones the general public can selectively empathise with.

To give an example, environmentalists will demand for the speed limit to be drastically reduced in a crowded city without even computing how much more pollution it will cause to have car exhaustions pipes constantly overwork. In the same manner, they criticise cryptos’ energy consumption without making a fair comparison against how much it costs to sustain a fiat currency. Just think of all the people, trees, printing presses, handling processes like chargebacks and disputes, as well as powering all the machines and work places.

Not only is PoW already more sustainable, but it will soon be replaced by a completely different consensus PoS (proof-of-stake) that will see energy consumption drop by 99%. The first big cryptocurrency to switch to this consensus is Ethereum.

Understanding the NFT hype

Most will fail to understand why NFTs are sought after. The most valuable thing about them is the accessibility of the history of a specific collectible/NFT. Unlike a Mona Lisa painting or Andy Warhol poster, a certificate provides public proof of an NFT art piece or its series come from, as well as who its past owners were.

It’s important to note that once a person purchases a digital-only NFT, they have access to the original file. This makes original files subject to illegal distribution via ‘underground’ channels such as Telegram private groups, which might make you wonder why you can’t just screenshot the NFT or purchase it and sell the original file for less?

Well, you could, but no-one (with minimal investing knowledge) would buy it. If you’ve been to the Louvre, you must’ve snapped a photo of Mona Lisa. But will anyone buy that photo from you? Highly unlikely.

Twitter user gmoney.eth explains the value behind NFTs perfectly by comparing it to a Rolex. A Rolex is just a cheesy “flex” used to show off an asset which could be real or fake – no-one. Whereas placing a cryptopunk NFT as your avatar gets you automatically recognised as someone who supports the artist alongside others in the NFT community. It will also prompt people to check your NFT collection to see if you actually own it.

What’s also revolutionary about NFT art is that artists can set up and receive royalties on NFT marketplaces. If you set royalties of a certain piece at 10% (which is the most common royalties percentage), you would receive 10% of royalties for that NFT art piece every time someone buys it, regardless of how many owners it goes through.

Journey of an art piece – From art to NFT

NFTs are posted on marketplaces like OpenSea, Rarible, or SuperRare, for which the user has to create a profile connected to crypto-wallets like CoinBase, MetaMask, or TrustWallet. Think of OpenSea as a big bazaar bringing together NFTs from other marketplaces like Rarible or SuperRare. However, if an NFT is placed on OpenSea, it will only be visible there.

Before posting an NFT, the marketplace will ask the users whether they want to make it a one-of-a-kind collectible or a series. A one-of-a-kind collectible will show up as 1/1 and series as 1/10 (if the user decides that there are 10 of them available for purchase).

The user can then decide whether it will be sold for a fixed price (can be instantly purchased), as a timed auction where the NFT goes to the highest bidder after the time runs out, or an unlimited auction where the users can choose to accept a bid whenever it reaches the price they want to sell it for. Most NFTs put out are purely digital, but some come with a tangible edition as well which is then shipped to the buyer.

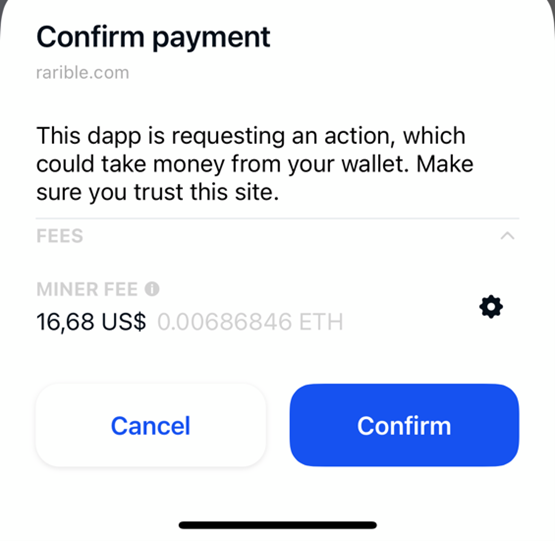

The next step is when users can choose the percentage of royalties they wish to receive each time someone purchases your collectible. After that’s done, the user proceeds to create an NFT. This is where the process of minting begins. Upon choosing to mint (create) the item, Rarible will push a notification to user’s crypto wallet asking for miner fees a.k.a. ‘gas fees’ to be paid for the piece to be ‘minted’ or ‘created’.

Remember that miners solve equations and encrypt every transaction into the blockchain. Depending on how many transactions (amount of work for miners) there is on a particular day, the transaction cost (gas fee) can range from a few dollars to a couple of hundred dollars. Hence in March 2021, the user would pay around $100 for minting an NFT, but today (29 May) that same user can mint it for only $16 (or 0.00686846 Ethereum).

Buying an NFT works the same as selling it. Once the users proceed to purchase an NFT, a notification from their crypto wallet will prompt them to pay a certain amount of the miner fees.

Companies who were early adopters of NFTs

NFTs aren’t just popular among artists, musicians, and influencers. Brands are coming for their piece of the cake as well.

Fashion quickly found its way into NFTs. Digital Fashion House The Fabricant sold their Iridescent dress NFT for around $10.000 in 2019. Artist Danit Peleg sells clothing patterns for 3D printers as NFTs. And Nike is supposedly working on NFT sneakers that might be released this year.

Other brands like StayCoolNYC opted for collaborating with NFT artists on Rarible.

Minecraft also found a way to introduce NFTs to its audience with a bit of help from Microsoft. The pair launched a browser game that rewards players with NFTs within Minecraft.

Pizzahut, on the other hand, managed to earn around $8.000 selling their NFT pizza slices on Rarible. Taco Bell joined Pizzahut on Rarible.

Interestingly, there was even a failed attempt to sell real estate as NFTs via an OpenSea auction. Shane Dulgeroff, NFTs owner, didn’t manage to sell it, but it doesn’t mean it couldn’t become the way real estate is auctioned in future.

Are NFTs here to stay?

What could ultimately determine whether NFTs are here to stay is Etherum’s move to Ethereum2. The unsuccessful integration of new upgrades from Ethereum 2 will make NFTs an industry standard – or a thing of the past. Environmentalists’ obsession with energy consumption waste could see governments confiscating more mining equipment. An unsuccessful move from a proof-of-work to proof-of-stake could leave miners unable to authenticate transactions, meaning the entire system could collapse.

There have been plenty of examples of brands that are already using NFTs to their advantage. Emakina’s clients are one of them. Emakina.FR has joined forces with Arianee to offer brands digital representation of physical objects that is perfectly tamper-proof and unique. On a quest to eradicate the counterfeit market, they enrich products with digital passports that guarantee authenticity while protecting privacy.

Whether it’s useful for every single company to jump on the NFT bandwagon is still up for debate. But if anything, at least it brings them great publicity.

Most importantly, NFTs give well-deserved exposure to artists. NFT artists and traders are optimistic.

Christian Borbolla, a hyperrealistic artist from Mexico, just minted his first NFT art piece : “It’s becoming hard for artists to get their name out there or differentiate themselves, and these NFT marketplaces are a perfect way to do so. The NFT marketplace forums are welcoming and full of like-minded, art-appreciative individuals. It makes communication even richer compared to social media networks or emails. I am planning to start with a combination of digital and tangible artwork and I’m looking forward to minting more artworks.”

Steve Munro, a multi-award-winning Melbourne-based pop artist with a rich background in cinematography shares the same enthusiasim: “My belief is that NFTs are not only a permanent tool for artists, but they will ultimately see the demise of the current work-practice of galleries. As I write this, the state of Victoria has gone into a snap seven-day lockdown due to a Covid outbreak in Melbourne. And, you know, the experiences we have had over the last year-and-a-half with Covid, and the disruption and damage it’s brought to us, has conditioned us to understand that it is possible to sell art online, and, so, change is here to stay.”

Keep an eye on our blog so you don’t miss out on a full interview with Steve Munro (SMARTPopArtist on Rarible) where he reveals yet another NFT marketplace on the rise and all about his experiences with NFT creation and trading.

Our recent blog posts

See all blogs-

How is AI’s synthetic data enhancing User Experience Research? Technology

-

Web3.AI Rising : How new technology can add value to your business

-

How generative AI helped us create an e-commerce app – with personalised content – in just 2 weeks Technology

-

Can you build a foodie app in 3 days using Generative AI? (Spoiler alert: yes!)